Opportunity Bank Uganda Limited (OBUL) is a member of the Opportunity Transformational Inc (OTI). In December 2008, OBUL acquired a Tier 2 Financial Institutions license from Bank of Uganda to operate as a regulated Credit Institution making OBUL effectively a Savings & Loan Organisation offering micro loans, savings and insurance products specializing in transformational lending in urban, peri-urban and rural environments. In July 2016, MyBucks, a Frankfurt listed FinTech company, acquired 49% of OBUL and is strengthening the banks’s digital banking footprint.

By providing financial solutions and training, OBUL empowers and sustains undeserved and financially excluded people throughout Uganda, especially in rural areas, to transform their lives, their children's future and their communities.

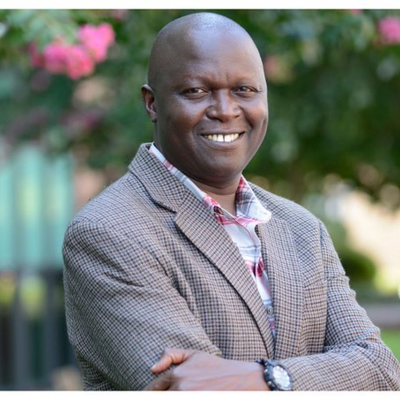

Robert Ongodia has been appointed Chief Executive Officer of OBUL.

Mr. Ongodia was the non-executive director of UGAFODE Microfinance Limited and a senior director of global investments at Accion. He holds a master’s degree in public administration from Columbia University of New York and a bachelor of science in economics from Makerere University.

He worked with Musoni Kenya Limited as a non-executive director, Microvest Capital Management, FINCA Microfinance Bank Tanzania and FINCA Uganda.

He has also lectured international economics at Makerere University, served Bank of Uganda as Banks Examiner, worked at the World Bank as a ‘short-term consultant’ and headed the loans department at Centenary Bank (1996-1999).

General information

| Borrower | Opportunity Bank Uganda Limited |

| Country | Uganda |

| Head office | Kampala |

| Website | http://www.opportunitybank.co.ug/ |

| Founded | 1 January 1995 |

| Active on Lendahand since | 1 August 2017 |

Financial information per 2021-06-30

| Portfolio Overview | €29,259,453.99 |

| Leverage ratio | 11.96% |

| Write-off ratio last 12 months | 0.22% |

| % investment amount in arrears (>90 days) | 9.34% |

About Uganda

Uganda gained independence from Britain on 9 October 1962 as a Commonwealth realm with Queen Elizabeth II as head of state. One year later, Uganda became a republic but maintained its membership in the Commonwealth of Nations. The country has been experiencing consistent economic growth. In 2015-16, Uganda recorded gross domestic product growth of 4.6 percent in real terms. However, despite making enormous progress in reducing the countrywide poverty incidence from 56 percent of the population in 1992 to 24.5 percent in 2009, poverty remains deep-rooted in the country's rural areas, which are home to 84 percent of Ugandans.

Last funded project

Tuliwalala Group

With a loan of EUR 17,500 the 20 members of the Tuliwalala Group will be enabled to upgrade and expand their businesses hence improving their standard of living.