Microfinance as a Lifeline for Many Entrepreneurs in Timor-Leste

Join us to Timor-Leste where we visit Kaebauk to better understand how your financing is being used to combat poverty and foster economic prosperity in the country.

Written by Lynn Hamerlinck on 26 September 2024

Dirkjan Vis is an online entrepreneur who is passionate about what's happening in the investing world. He shares his experience as a crowd investor at Lendahand.

Join us to Timor-Leste where we visit Kaebauk to better understand how your financing is being used to combat poverty and foster economic prosperity in the country.

The historical return on investments in Financial Institutions on Lendahand is now 3.9% per year (and rising!).

How does Funding Societies transform financing into tangible impact and positive change in Southeast Asia? We talk to their client Beleaf Farms, an innovative scale-up that is transforming the lives of many farmers and the agricultural sector in Indonesia.

"Who exactly are these entrepreneurs I invest in?" I sometimes wondered. Since March 2020, I've been investing in projects through Lendahand to do something good with my money in distant countries. As an avid traveler, I've since visited several countries where I've supported local entrepreneurs through crowdfunding.

It's here: Lendahand's Impact Report 2023. The report is not just numbers; it also features various stories of entrepreneurs we supported with your investments last year.

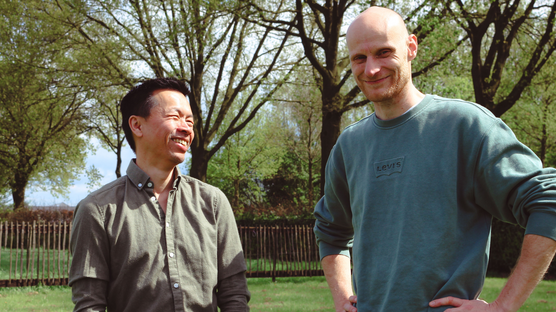

CEO Arno Hoogenhuizen briefly introduces himself and answers the question of what the leadership change means for Lendahand and especially for you as an investor.

CEO Koen The thinks it’s time to step down and pass the torch to others now that Lendahand is an established social enterprise.

After ten years, co-founder and CEO Koen The thinks it is time for new leadership at Lendahand and makes way for Arno Hoogenhuizen.

What does transitioning from a license as an investment firm (MiFID) to the ECSP license mean? Find all the information here.

One month after launching Auto-Invest, it's time for a first assessment of our newest functionality. Read more about the results here.

Enter your email below to receive an email every time we publish a new blog post.